After experiencing a round of irrational upstream capacity expansion, the LED industry seems to have entered the "harvest period" of the downstream application market.

Statistics show that the output value of China's LED industry reached 154 billion yuan in 2011, an increase of 22% year-on-year, while the output increased by more than 50% year-on-year. It is estimated that in 2012, driven by the lighting application market, the industry output value is expected to reach 200 billion yuan, an increase of 30% year-on-year.

According to the industrial goals mentioned in the "Twelfth Five-Year Plan for Energy-saving and Environmental Protection Industry Development" previously issued by the State Council, by 2015, the market share of general lighting products will reach about 20%, and the output value of the LED lighting industry will reach 450 billion yuan.

It is true that the industrial development model with Chinese characteristics has spawned a huge LED lighting market, but at the same time it has masked the industrial drawbacks such as product structure adjustment, technological R & D gap, market change tolerance, blind listing, and excessive capacity expansion.

Low-cost market grabbing under the expansion of production

Once upon a time, LEDs were the most popular sweets for everyone, from sapphire substrates, MO sources, epitaxial wafers, down to LED street lights, etc., enterprises in almost every link of the industry chain can make a lot of money. But the good times are not long. Over the past two years, there have been many influxes into the market, and the current market situation of oversupply has made many LED companies begin to miss the scene of order queuing that year. "Now the company's life is very sad. In the past two or three years, LEDs have moved from aristocratic products to civilian products, and they have reached 'garbage' products in an instant." An LED indoor lighting practitioner complained to reporters.

The reporter reviewed the data of the third quarter financial statements of several listed companies. "The market competition is becoming increasingly fierce. Although the sales volume has maintained a certain increase, the decline in product prices has led to a decrease in revenue and a decline in net profit." The description is almost everywhere.

Although the relevant government departments have drawn a pie with a market size of nearly 500 billion yuan for this industry, the reality is that in the face of tens of thousands of domestic LED lighting companies, the market cake is far less than everyone thinks. "Everyone is rushing to eat, and the degree of fierce market competition can be imagined." Zhang Hongbiao said that since the first half of 2011, there have been nearly 1,800 new domestic LED indoor lighting companies. Among them, in the first half of this year alone, there were nearly 1,000 new companies.

As the first MO source listed company in China and a major supplier of raw materials for domestic LED epitaxial plants, Nanda Optoelectronics could not escape its performance in the first half of the year. The company's financial report disclosed that in the first half of the year, Nanda Optoelectronics achieved an operating income of 112 million yuan, a year-on-year decrease of 15.48%, and a total profit of 64.386 million yuan, a year-on-year decrease of 27.15%. Nanda Optics attributed the decline in revenue to "the market prices of MO source products returned to rationality. Although the sales volume increased substantially year-on-year, the decline in sales unit prices led to a decline in operating income and a decrease in product gross profit margin." Data show that the company's main product trimethylgallium (one of the main raw materials for LED epitaxial growth) prices fell from a high of 35,300 yuan per kilogram in the third quarter of 2011 to 21,400 yuan per kilogram in the second quarter of this year, the price fell by nearly 40 %.

The fall in upstream raw material prices also confirms the overcapacity of the industrial chain and fierce market competition from another aspect. "As the mainland's subsidies for the upstream LED industry will end in 2014, mainland LED chip factories may only have five in 2015." This is the recent statement of Li Bingjie, chairman of Taiwan Epistar Optoelectronics.

Compared with the stable supply chain system of Taiwan LED chip factories, Li Bingjie's above statement also shows that after losing the support of government subsidies, the mainland LED chip factory will have a battle for the future downstream customers. Perhaps no one wants to be the one to be knocked down, especially during the critical period of capacity expansion. The most convenient way to win the market is a price war, and sacrificing gross profit margins can only be a frustrating move for most companies, because no market share means an increase in inventory and a significant depreciation.

Huacan Optoelectronics, which has just landed in the capital market this year, recently announced the first half of the financial report. The data shows that the company achieved operating income of 187,771,500 yuan, a decrease of 17.97% from the same period of the previous year; total profit was 43,635,800 yuan, a decrease from the same period of the previous year 39.25%; net profit was 37.704 million yuan, a decrease of 39.40% over the same period of the previous year.

For the main reason for the decline in profits, Huacan Optoelectronics stated in its financial report: due to the impact of intensified market competition, the unit price of chip sales fell more than expected, and the company ’s expanded production capacity has not yet been fully formed and released during the same period, resulting in chip sales in the first half of the year. The number exceeds the number of production and storage, which is also higher than the same period last year, but sales revenue and gross profit still decline, and net profit is significantly lower than the same period last year.

In the field of red-yellow light chips with relatively high gross profit margins in the past, Qianzhao Optoelectronics achieved revenue of RMB 193,304,700 in the first half of this year, although it increased by 6.03% over the same period of the previous year, but realized a net profit of RMB 63,796,600. Compared with the same period of last year, it has decreased by 27.43%, and the gross profit margin of the chip has dropped by 20.47%.

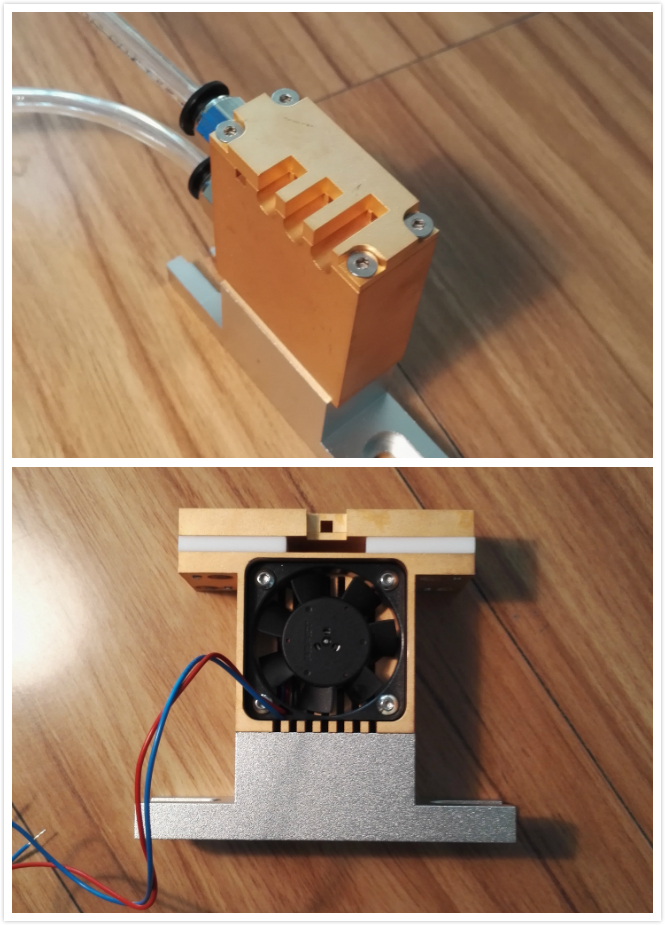

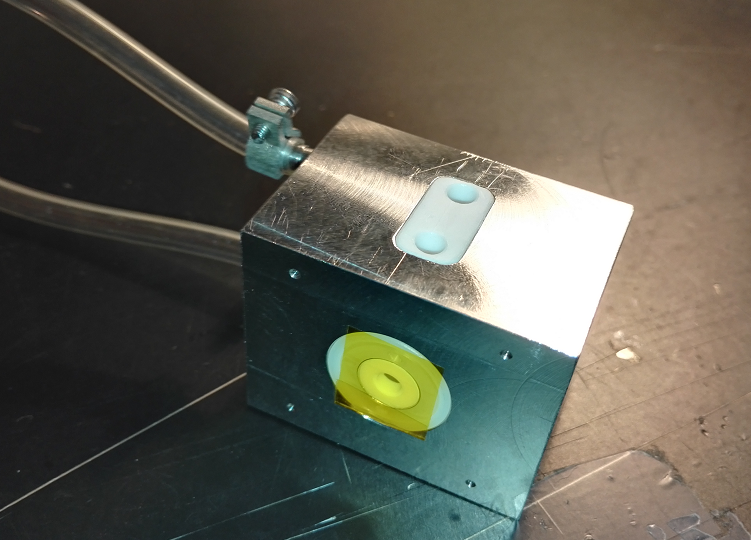

Coupletech Co., Ltd also supplies water cooled modules, air cooled modules and heat-sink system for high power laser. Usually we need to use all kinds of methods, e.g. water cooling, air cooling and heat sink to make the Laser Crystal, nonlinear crystal and Pockels Cell work normally within specified operating temperature range. Thus we need crystal mounts with water cooling, air cooling or heat sinking.

Narrow Aluminium Optical Rail,Narrow Aluminium Rail Carriers,Aluminium Optical Rails

Coupletech Co., Ltd. , https://www.coupletech.com